-

Heon Lee

Email: heonlee68 [at] gmail.com

Publication

-

On the Instability of Fractional Reserve Banking

European Economic Review, 178:105111, September 2025

(1) draft (2) slides (3) code

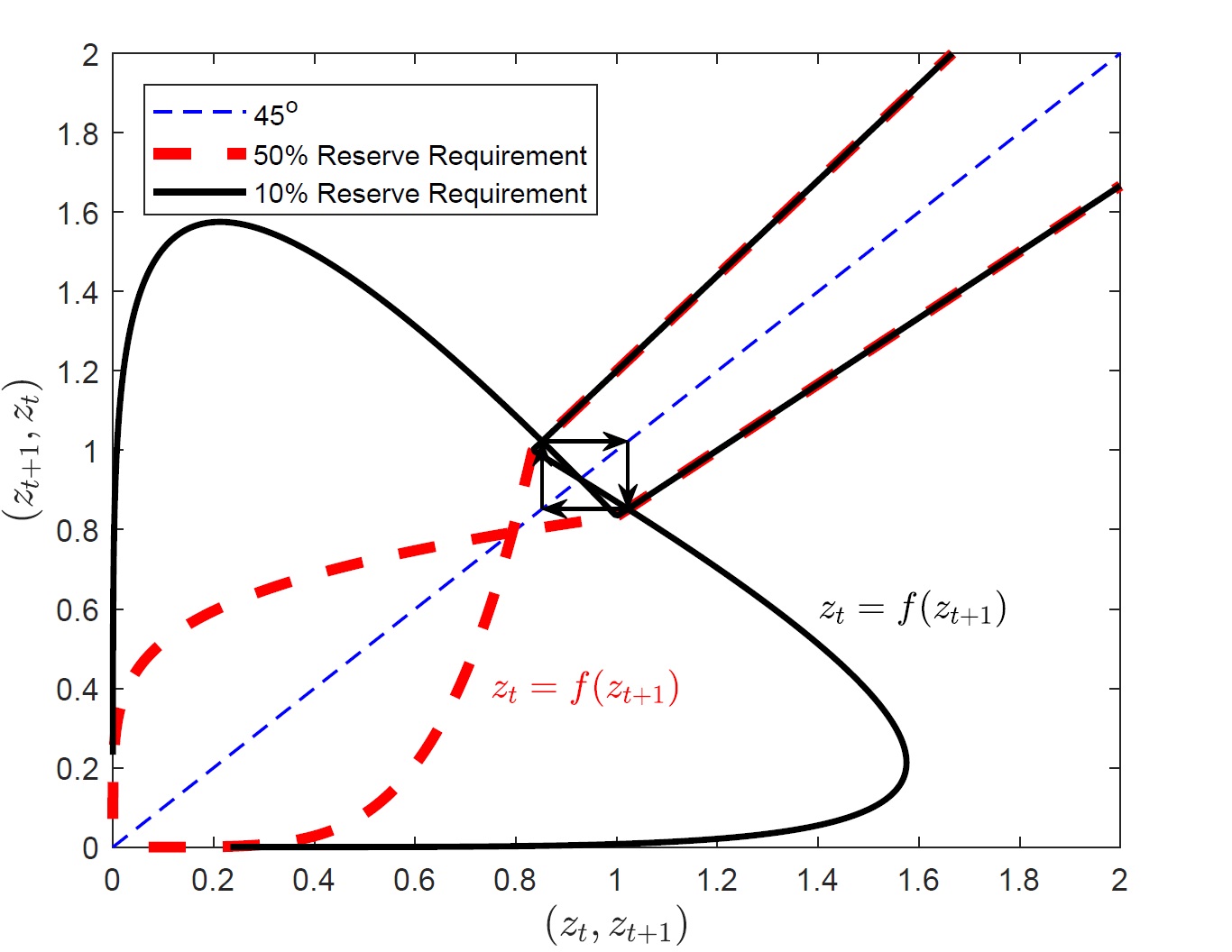

This paper develops a dynamic monetary model to study the (in)stability of the fractional reserve banking system. The model shows that the fractional reserve banking system can endanger stability in that equilibrium is more prone to exhibit endogenous cyclic, chaotic, and stochastic dynamics under lower reserve requirements, although it can increase consumption in the steady-state. Introducing endogenous unsecured credit to the baseline model does not change the main results. This paper also provides empirical evidence that is consistent with the prediction of the model. The calibrated exercise suggests that this channel

could be another source of economic fluctuations.

This paper develops a dynamic monetary model to study the (in)stability of the fractional reserve banking system. The model shows that the fractional reserve banking system can endanger stability in that equilibrium is more prone to exhibit endogenous cyclic, chaotic, and stochastic dynamics under lower reserve requirements, although it can increase consumption in the steady-state. Introducing endogenous unsecured credit to the baseline model does not change the main results. This paper also provides empirical evidence that is consistent with the prediction of the model. The calibrated exercise suggests that this channel

could be another source of economic fluctuations.

Working Papers

-

Money Creation and Banking: Theory and Evidence

(1) draft (2) slides

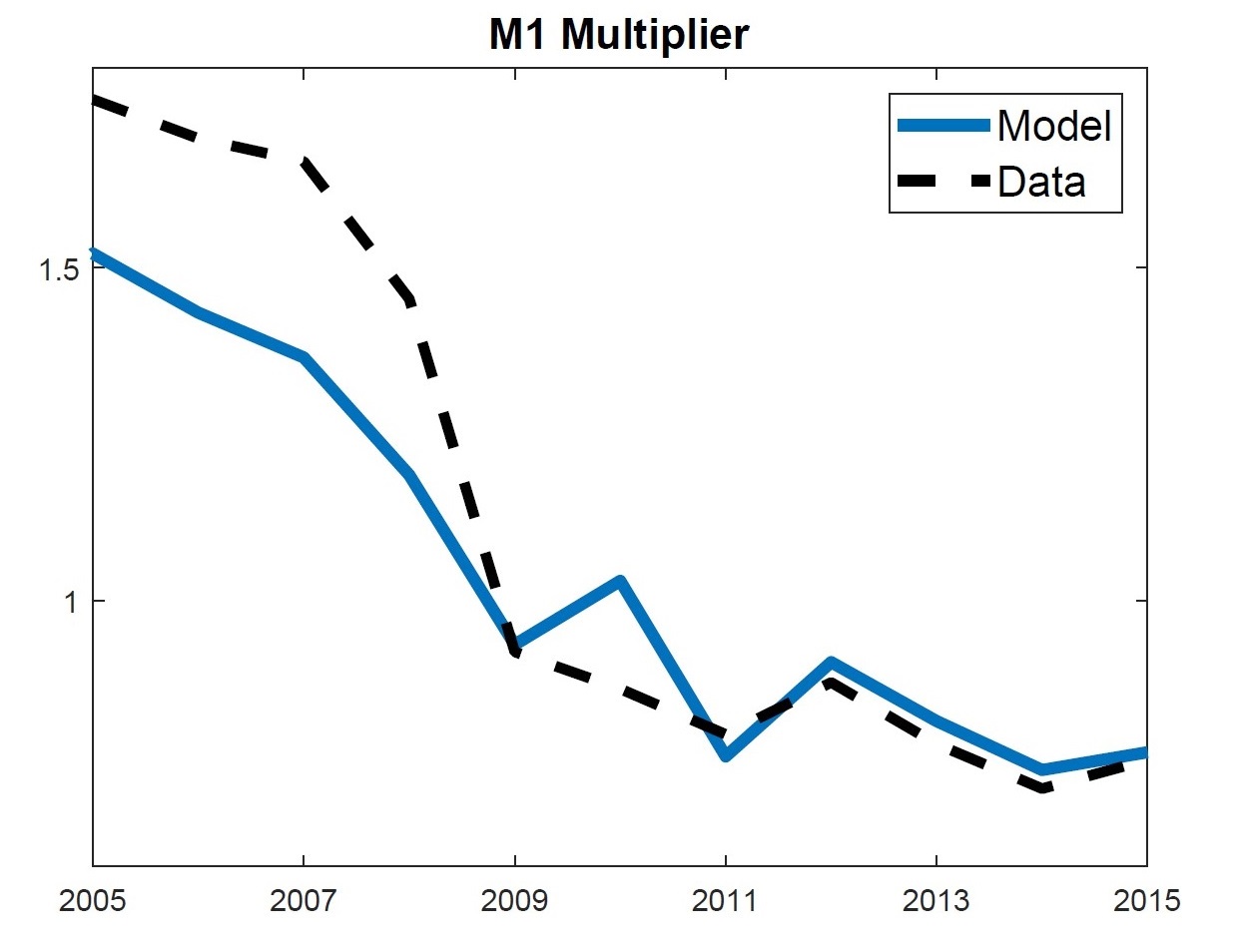

This paper studies the role of banks’ money creation in monetary transmission. I develop a monetary-search model in which the demand for the monetary base and the money multiplier are endogenously determined through the banks’ money creation channel. Both the model and data show that short-term policy rates and interest on reserves play distinct roles in monetary transmission. I evaluate the theory by matching it with data, and the calibrated model can account for the evolution of the quantity of reserves, excess reserves, and the money multiplier from 1968 to 2015.

This paper studies the role of banks’ money creation in monetary transmission. I develop a monetary-search model in which the demand for the monetary base and the money multiplier are endogenously determined through the banks’ money creation channel. Both the model and data show that short-term policy rates and interest on reserves play distinct roles in monetary transmission. I evaluate the theory by matching it with data, and the calibrated model can account for the evolution of the quantity of reserves, excess reserves, and the money multiplier from 1968 to 2015.

- Money, Capital and Open Market Operation (with William Park)

- Money Demand and Inflation: International Evidence (with Christian Wipf)

Work in Progress

- Show Me the Money: A Reconstruction of M1 Series and Its Implication (with William Park)

-

Operation Twist: A Tale of Two Maturity (with Sungmin Park)

- Fiscal Theory of Price Level in Monetary Economies (with Christian Wipf)

-

Joint Fiscal and Monetary Policy without Commitment

(with Saroj Dhital)

Conference Discussions

-

Central Bank Digital Currency, Credit Supply, and Financial Stability

by Young Sik Kim and Ohik Kwon

Paper, Discussion at the KIEA Annual Meeting, December 2019.

-

The Effects of Sector-Specific Credit Supply Shocks on the U.S. Economy

by Maximillian Littlejohn

Paper, Discussion at the MVEA Annual Meeting, October 2020.

Useful Links

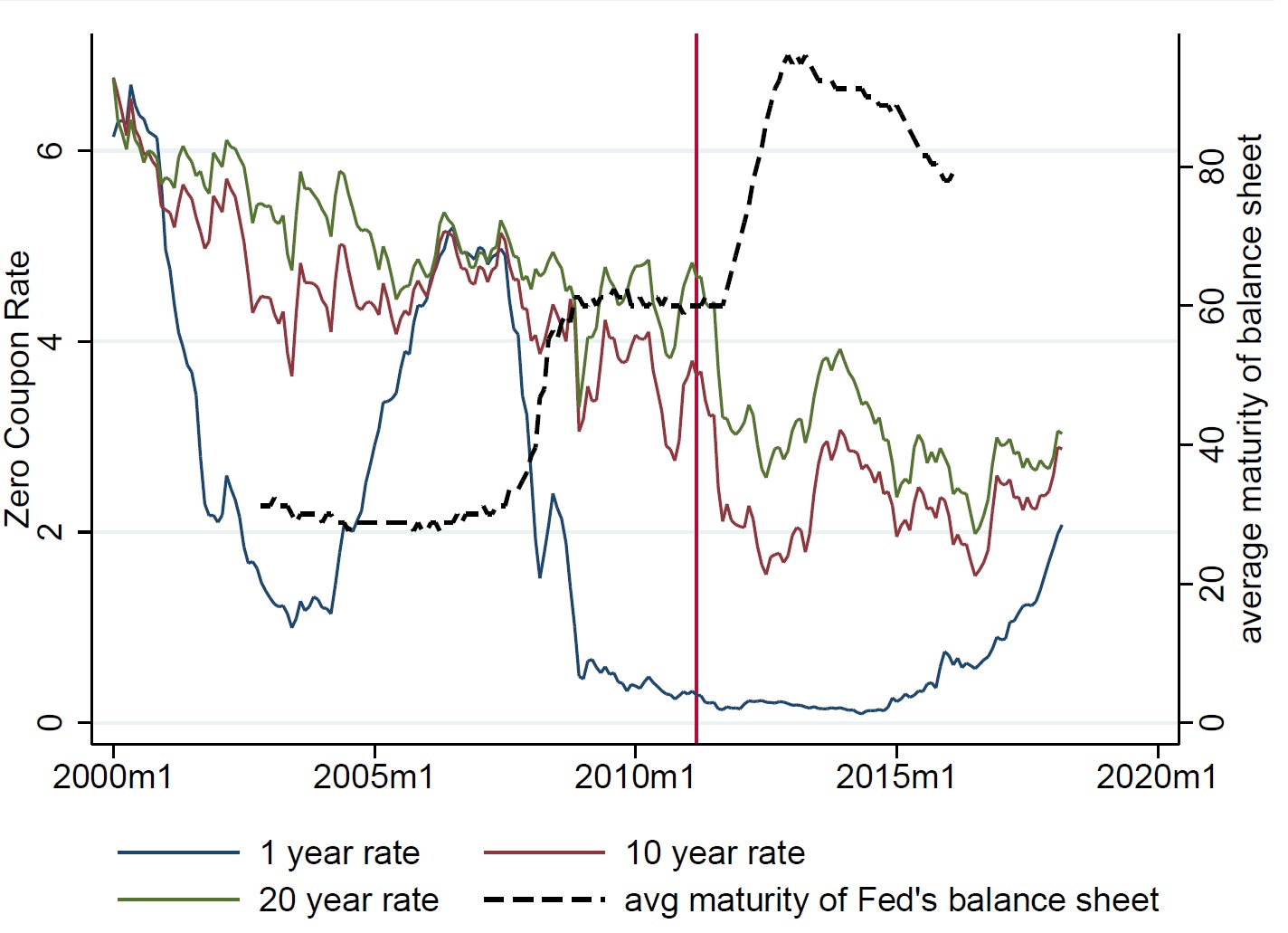

I construct a search-theoretic model of the term structure of interest rates to examine the role of maturity management by the fiscal authority and the central bank. In the model, an increase in the central bank's balance sheet's maturity decreases the long term interest rate while an increase in maturity of outstanding government bond increases the long term interest rate. I study the interaction of two different authorities' maturity managements and how these two policies can be coordinated.

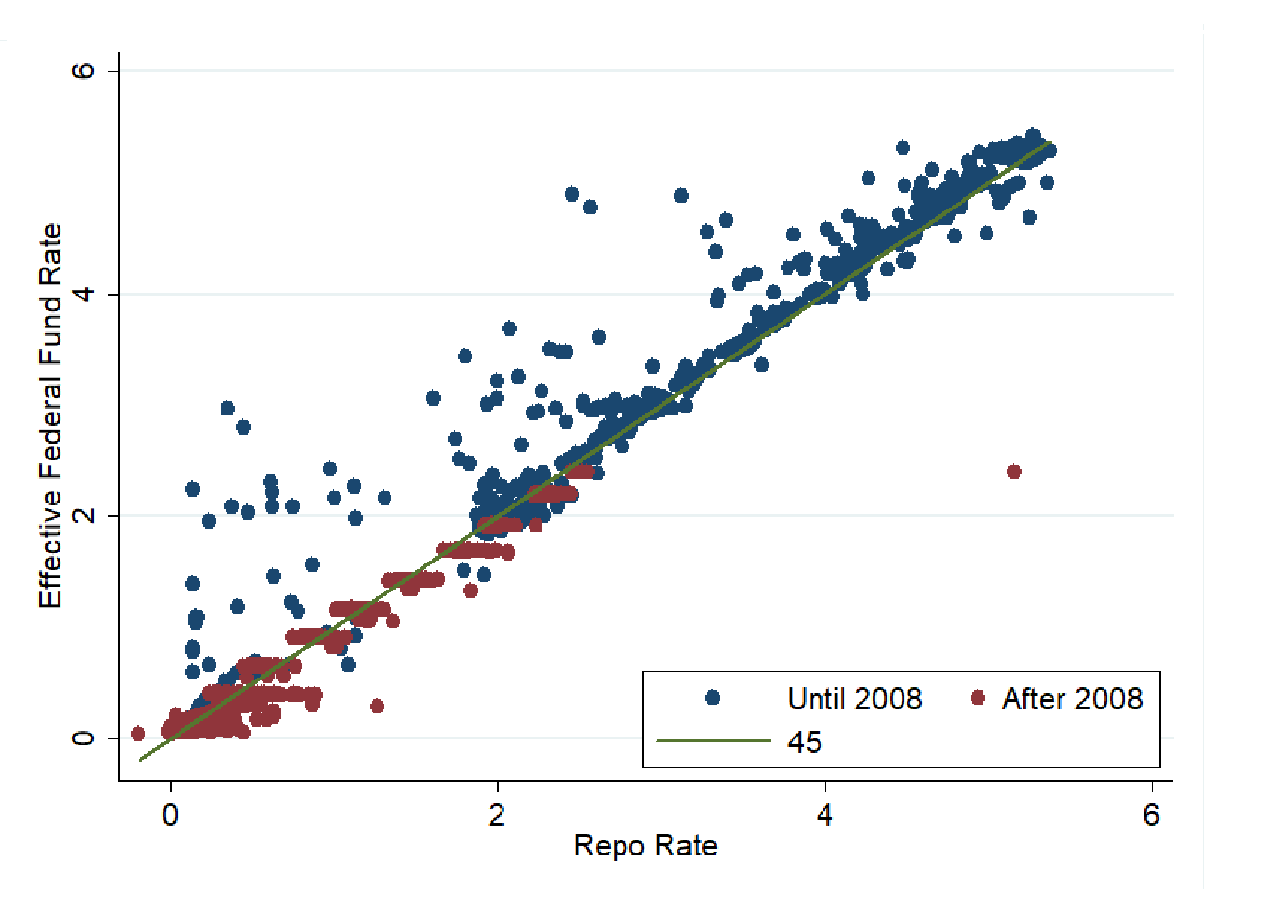

I construct a search-theoretic model of the term structure of interest rates to examine the role of maturity management by the fiscal authority and the central bank. In the model, an increase in the central bank's balance sheet's maturity decreases the long term interest rate while an increase in maturity of outstanding government bond increases the long term interest rate. I study the interaction of two different authorities' maturity managements and how these two policies can be coordinated.  After the Great Recession, the Federal Reserve conducts open market operations in the repo market to keep the interbank lending rate in the federal funds market within its target range. Given the over-the-counter nature of the fed funds market, I construct a search model of federal funds and repo market to examine (1) pass-through from the repo market to federal funds market; (2) the role of ON RRP facility for monetary policy implementation; and (3) effect of the introduction of standing repo facility.

After the Great Recession, the Federal Reserve conducts open market operations in the repo market to keep the interbank lending rate in the federal funds market within its target range. Given the over-the-counter nature of the fed funds market, I construct a search model of federal funds and repo market to examine (1) pass-through from the repo market to federal funds market; (2) the role of ON RRP facility for monetary policy implementation; and (3) effect of the introduction of standing repo facility.